The world's 100 largest banks

AuthorFrancis GarridoSaqib Chaudhry

|

Despite global trade tensions and a weakening yuan, Chinese banks continued to grow and remain among the world's largest, the latest global bank ranking from S&P Global Market Intelligence shows.

China's "Big Four" banks — Industrial & Commercial Bank of China Ltd., China Construction Bank Corp., Agricultural Bank of China Ltd. and Bank of China Ltd. — continued to dominate the top of the ranking. All four now have more than $3 trillion in assets and have a combined asset value of $13.784 trillion, 1.07% higher compared to a year ago. The annual increase would have been 6.84% without the impact of exchange rates. China's yuan lost more than 5% against the U.S. dollar over the course of 2018 amid an ongoing trade war between the two economic giants.

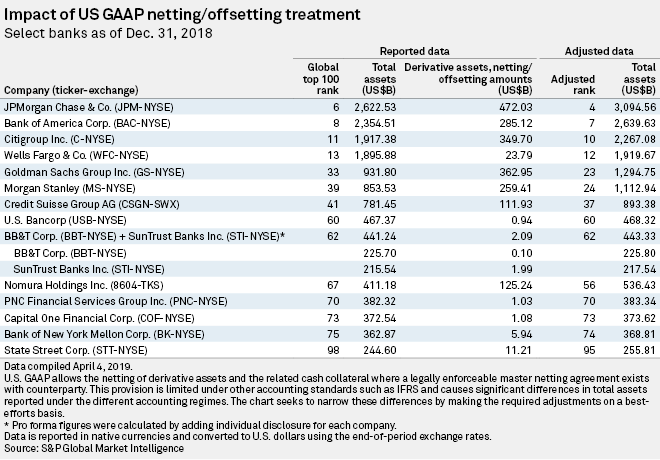

In the latest ranking, company total assets were adjusted for pending mergers, acquisitions and divestitures, as well as M&A deals that closed after the end of the reporting period through March 31 on a best-efforts basis. Assets reported by non-U.S. dollar filers were converted to dollars using period-end exchange rates. Total assets were taken on an "as-reported" basis and no adjustments are made to account for differing accounting standards. The majority of the banks were ranked by total assets as of Dec. 31, 2018. In the previous ranking published April 6, 2018, most company assets were as of Dec. 31, 2017, and were adjusted for pending and completed M&A as of March 31, 2018.

In addition to China-U.S. trade relation concerns, uncertainty over negotiations for the United Kingdom's exit from the European Union and worries of a slowing global economy helped to strengthen the dollar against most major currencies in 2018, which in turn aided the majority of the U.S. banks against its international peers in the ranking.

U.S.-based Bank of America Corp. overtook France's BNP Paribas SA to take the No. 8 spot in this year’s ranking, the highest it has been since S&P Global Market Intelligence began publishing global bank rankings in 2013. The U.S. lender grew its assets by 3.21% year over year to $2.355 trillion at the end of 2018. Meanwhile, BNP Paribas' assets slipped by 0.32% to $2.337 trillion due to strengthening of the dollar against the euro despite its assets increasing 4.54% in euro terms. (To see the full impact of currency conversions on the 100 largest banks, download the Excel file from the Product Tips box at the bottom of the article.)

This year's ranking also includes two new entrants: China Zheshang Bank Co. Ltd. which landed on the No. 99 spot with assets of $239.43 billion, and the combined entity to result from the pending merger of BB&T Corp. and SunTrust Banks Inc., coming in at No. 62 with pro forma assets of $441.24 billion. The deal, valued at $28.19 billion, is expected to be completed in second half of 2019.

Elsewhere in the U.S., JPMorgan Chase & Co. continued to be the country's largest bank, ranking at No. 6 this year. The banking giant would have ranked two spots higher, at No. 4, had it reported in IFRS instead of U.S. GAAP. Under IFRS, the gross value of derivatives are reported while U.S. GAAP requires the net value to be reflected.

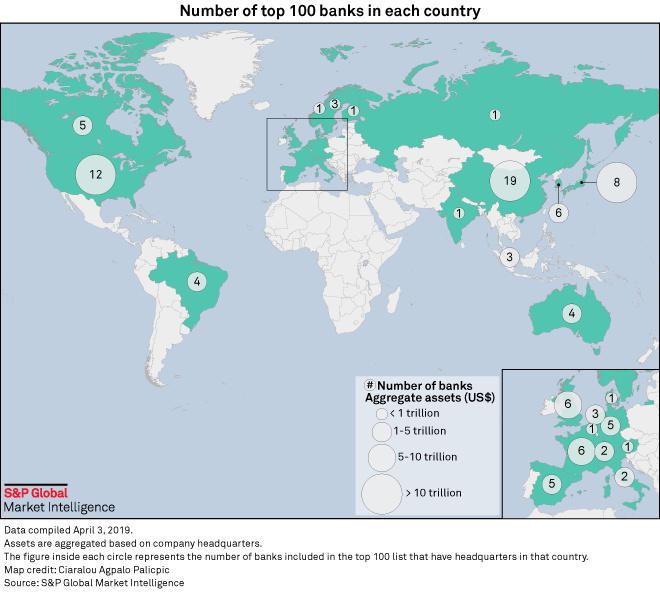

China remains to be home to the greatest number of Top 100 banks, with 19 institutions collectively holding assets worth $24.160 trillion. The U.S. followed next with 12 institutions holding combined assets of $12.847 trillion.